You’ve done all the necessary preparation for the telecom procurement process, forming and educating your procurement team and reviewing your company’s data. You’ve taken the time to establish and clarify your organization’s telecom needs and business objectives.

Now it’s time to identify potential vendors and figure out which are the best options to send requests for proposal (RFPs) to. Read on to learn about the different types of vendors you’ll want to consider.

Looking for expert input as to which vendors are the best potential matches for your business? Look no further. Here at Technology Procurement Group, we’ll be happy to help you. Give us a call at 1-888-449-1580, send us an email at info@TPG-llc.com, or fill out the form at the bottom of the page for more information.

Contents

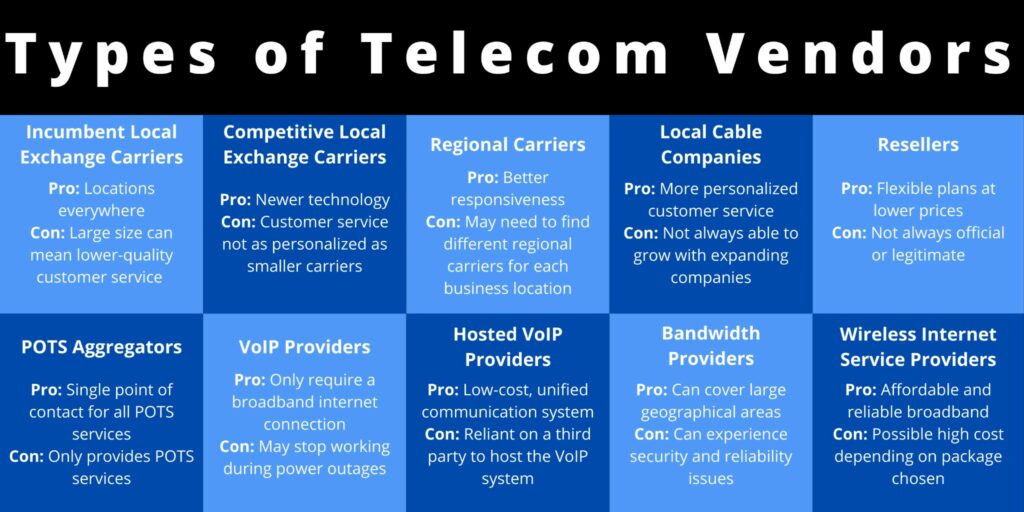

Types of Telecom Vendors

There are numerous kinds of telecom vendors that serve as viable options for different businesses.

Incumbent Local Exchange Carriers

Often referred to as ILECs, Incumbent Local Exchange Carriers are huge companies that originally provided service to a local area before 1996, when unbundling occurred as a result of the Telecommunications Act.

These providers have been mandated to maintain copper services countrywide. Many urban and densely-populated locations have moved on to wireless and fiber optic services, but there are still various rural areas that are reliant on ILECs.

One of the most significant downsides of choosing an ILEC is that they are so large. Unfortunately, their size can become a weakness when it comes to customer service. Still, an ILEC may be the only option if a business is located in a particularly rural area.

Another situation in which an ILEC may be the best choice is if a company has offices spread across multiple locations in the country. Centralizing the business’s telecommunications services makes them less of a hassle to manage. Therefore, going with a single ILEC may be better than selecting a different provider for each location.

Some of the major ILECs include AT&T, CenturyLink, and Verizon. AT&T and Verizon have both expanded from copper services to deliver wireless services as well.

Competitive Local Exchange Carriers

Competitive Local Exchange Carriers, or CLECs, are telecom providers that compete with the incumbent local exchange carriers.

After the 1996 Telecommunications Act, many smaller local carriers began to establish themselves. In the beginning, they leased copper lines from the ILECs. The difference was that their smaller size and lower infrastructure costs allowed them to offer better pricing and improved customer service.

Now, many CLECs have consolidated to form larger companies, which are currently building their own fiber-optic networks and offering a more extensive range of services.

With their advancement in areas like wireless and Voice-over-IP technology, CLECs have a unique setup that allows them to provide a full range of telecom services to their respective regions. Perks of choosing a CLEC include more personalized customer service and support, as well as newer and more well-maintained technology.

Today, some of the major CLECs include Zayo, XO, Windstream, and Atlantech Online. However, there are many more, depending on the company’s location.

Regional Carriers

Regional telecom carriers are simply carriers that operate in a particular region. Large companies that span multiple regions may find it simpler to go with a national carrier, unless they’re willing to select a separate regional carrier for each of their business locations.

One benefit of choosing a regional carrier is that their smaller size generally means better responsiveness and a more personalized relationship with customer support staff.

Plus, overall costs can be lower when enterprises utilize multiple regional carriers instead of selecting one national or global carrier. Some examples of regional carriers include Integra, Telepacific, and One Communications. Of course, the regional carriers available vary by location.

Local Cable Companies

Local cable companies are even smaller than regional carriers and carry many of the same benefits. However, a drawback is that they are typically less likely to be able to grow with an expanding company. For this reason, they’re generally a better option for smaller businesses. Some examples of local cable companies include Comcast, Cox, and Time Warner, among others.

Resellers

Resellers are companies that purchase telecommunications tools, equipment, and network access from more prominent equipment manufacturers and network carriers. They then resell their purchases to businesses and households.

Most of the major carriers offer network access to resellers wholesale. They also have their own reseller brands. A few examples include Boost Mobile (owned by Dish), Cricket Wireless (owned by AT&T), and Metro (owned by T-Mobile).

There are some advantages and drawbacks to working with resellers. First, the benefits: Resellers are smaller companies that can usually provide better customer service than the typical incumbent provider. They serve a smaller customer base, so they offer more personalized service. They can often provide flexible plans at lower prices as well, since they obtain their network access and equipment at wholesale prices.

Still, there are drawbacks to consider. Not all resellers are legitimate or official, which can lead to problems down the line. In addition, some resellers may not be in charge of operations at the facilities they’re using since they have leased or purchased their equipment from larger carriers.

POTS Aggregators

Many businesses have several different services that employ POTS (Plain Old Telephone Service), such as alarms, fax machines, DSLs (Digital Subscriber Lines), and voice services. A POTS aggregator consolidates and aggregates these separate POTS lines.

Aggregators typically have resale agreements with local phone companies, so they’re able to streamline various POTS services for clients, which can help with finances and administration.

Clients will receive a single invoice for all POTS services, and they’ll also have a single point of contact for all POTS customer service-related problems. Granite and Ernest are two POTS aggregators.

VoIP Providers

VoIP, or Voice-over-Internet Protocol, is a type of technology that uses broadband internet to make voice calls, rather than employing an analog phone line. VoIP is better than landlines as it often provides various features and services that simply aren’t possible with regular phone lines. More on that VoIP only requires a broadband internet connection to function.

Still, there are some drawbacks as well. For example, some VoIP services stop working during power outages, and VoIP providers don’t always offer a source of backup power. Another potential issue is that not all VoIP services can directly connect to 911 and emergency services.

Choosing VoIP over hosted VoIP (explained below) also involves installing a full in-house VoIP system, rather than employing a system hosted by a third party. This generally means that VoIP systems are more expensive than hosted VoIP systems. A few well-known VoIP providers are MegaPath, Cbeyond, and Broadview.

Hosted VoIP Providers

Hosted VoIP providers are third-party providers that offer internet-based phone communication services. Hosted VoIP is most often used by small businesses in search of a low-cost, unified communication system.

Hosted VoIPs are a replacement for traditional landlines and analog equipment because they’re cloud-based. Calls are converted into digital packets of data. These data packets are then sent using the internet.

This option comes with many different features, like call routing and screening, unlimited calling, extension numbers, instant messaging, voicemail, video conferencing, and online fax services. Some of the most popular hosted VoIP providers include Nextiva and RingCentral.

Bandwidth Providers

Bandwidth providers typically run using underground fiber-optic cables. These cables connect various points of presence worldwide and have their own IP network. Bandwidth providers sell their connectivity to various hosting providers and data centers.

Cogent, AboveNet, and Level 3 Communications are all bandwidth providers. This type of telecom provider is a good choice for large enterprises searching for an internet provider that covers a large geographical area. They can also work for small and midsize businesses.

Wireless Internet Service Providers

Also known as WISPs, Wireless Internet Service Providers offer affordable and reliable broadband to businesses, schools, and residences. Fixed wireless is the most rapidly-growing part of the broadband industry. This is thanks to its continuously evolving modes of transmission (such as fiber), rapid technology innovation, and cost-effective deployment.

Plus, wireless networks can be built and upgraded very quickly and at a much lower cost than satellite or wired-only technologies. WISPs are excellent choices for businesses in underserved urban areas, as well as the hardest-to-reach rural areas.

Selecting Potential Vendors

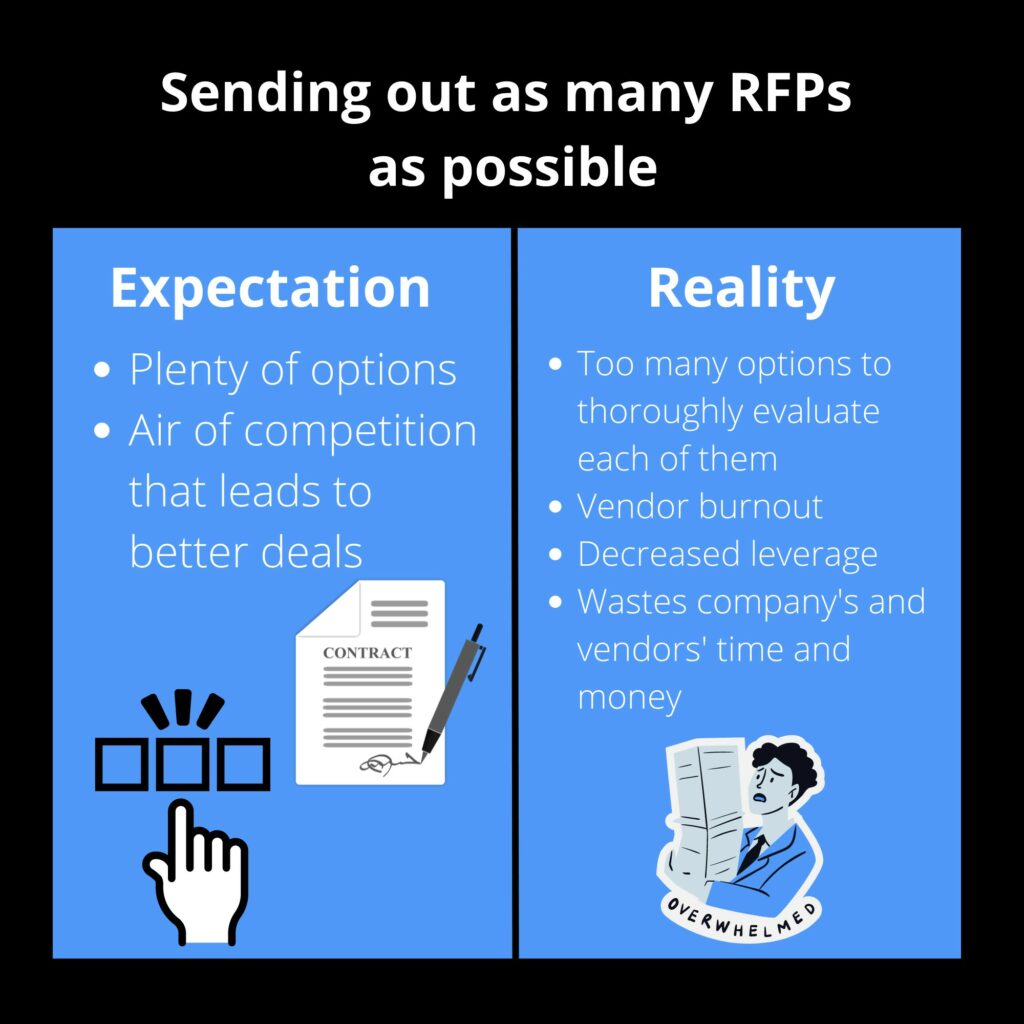

When deciding which vendors to send RFPs to, procurement teams must remember that more is not always better. In fact, casting a wide net is often counterproductive.

A common mistake in the telecom procurement process is sending out as many RFPs as possible in the hopes that this will provide the best options and create an air of competition between vendors.

A common mistake in the telecom procurement process is sending out as many RFPs as possible in the hopes that this will provide the best options and create an air of competition between vendors; which is completely wrong. You first need to define your organization’s procurement objectives and then reach out to potential vendors.

But in reality, the more RFPs a business sends out, the more proposals it will receive in return, and the longer it will take to evaluate all of them.

Why Businesses Shouldn’t Cast a Wide Net

One issue with sending out many RFPs is that it costs a business time and money. Each vendor that decides to respond to the RFP will also have to spend significantly in order to write RFP rejection letters.

On average, vendors spend anywhere from 2% to 10% of the potential revenue from the contract on their responses. This is because of the various expenses that go into writing up a proposal: the time spent on financials, pricing, and technical writing, the expenses of the technical and marketing teams, and so on.

Unfortunately, this 2% to 10% of the potential revenue is eventually passed on to the buyers. Therefore, procurement teams need to consider the vendors’ costs, not only their own, when sending out RFPs.

Repeatedly sending RFPs to vendors with slim to no chance of earning the company’s business can cause vendor burnout. Eventually, vendors tire of receiving RFPs from companies that don’t appear to have any intention of actually working with them.

As a result, they’ll stop responding and sending proposals back to these companies. In addition, frivolous RFPs can be reflected in vendors’ pricing over time, and some vendors may even hold on to their most innovative solutions for customers that are more favored.

In relation to the concept of leverage, procurement teams need to remember to match their actions to their words and to remain credible. When companies interact with telecom vendors, they’re essentially training these vendors on how to do business with them.

Ideally, vendors should be trained to know that the company means business when it sends out RFPs, and that they have a legitimate chance at winning the contract.

Another problem with sending out too many RFPs is receiving so many proposals in return that there isn’t enough time to give all of them a thorough evaluation.

It only takes an hour or two to go through one proposal, but if a company receives a dozen proposals, its procurement team will likely have to set aside two or three workdays to go through them all. This can lead to delays in the procurement process and communication with vendors, which can come off as unprofessional and disrespectful, especially considering the time and money each vendor put into its proposal.

The main takeaway here is that seeking more proposals than a company’s procurement team can handle wastes not only the company’s time and money, but also the vendors’ time and money.

Target RFPs to the Most Promising Vendors

The best strategy is to target RFPs to the vendors that are most likely to provide the best proposals. Professionals estimate that by properly vetting RFP recipients, procurement teams can cut back their hours spent evaluating proposals by as much as two-thirds!

All vendors receiving RFPs should be fully qualified commercially and technically. They also need to be acceptable, meaning that internal business partners must agree that each RFP recipient is satisfactory if they were to win the contract.

If a company selects an unqualified vendor, both the company and its credibility will suffer. As a result, the company will have less influence and leverage when it goes through the telecom procurement process again in the future.

Consider Sending Out RFIs

What if a company is unsure of which vendors are the most promising? In that case, RFIs (requests for information) are an excellent way to bridge the gap and provide businesses with more knowledge about the telecom market and what vendors have to offer. RFIs are shorter and less formal than RFPs. They’re only about three to five pages long and require less effort to put together. They’re also quicker and easier for vendors to respond to.

Generally, procurement teams don’t have to spend too much time evaluating RFI responses. Still, they’re extremely valuable because they clarify which vendors are best suited to meet the company’s telecom needs, thus identifying the vendors to which the company should send RFPs.

RFIs are also useful because they can ask vendors which other telecom providers are their main competitors. This can potentially provide more options for companies to look into and choose from.

In their RFIs, procurement teams can ask vendors what questions they should include in their RFPs, making the RFP writing process much simpler.

When evaluating RFI responses, procurement professionals should pay attention not just to the questions that the vendors answered, but also to the ones that they didn’t answer or provide much detail on. Oftentimes, the evasion of a question indicates a weak point for that particular vendor.

Hold Pre-RFP Meetings with Potential Vendors

Aside from sending out RFIs, another method of narrowing down the vendors to which a business will send RFPs is to hold pre-RFP meetings with all possible vendors.

These meetings allow companies to gain a fuller understanding of the vendors’ product and service offerings. They have many other benefits as well: meeting the account team, learning about what differentiates each vendor from the others, and answering any questions the vendor has about the bid.

Other parts of a pre-RFP meeting include going over unique service offerings and differences in features, covering API integrations, learning about the vendor’s technology roadmap involving future innovations, and discovering the vendor’s scope of work.

Vendors can also demo related software and portals for billing and service management. All of this information can make it easier to determine whether a vendor is a true candidate for the company and if it should be an RFP recipient.

If the enterprise chooses not to hold pre-RFP meetings, it’ll still want to allow written questions from all vendors. Once the questions have been received, the answers should be provided to all respondents. Maintain confidentiality and let vendors know that their company names will be withheld so that no one will know who asked certain questions.

Send Out Non-Disclosure Agreements

There are several reasons why sending out NDAs before RFPs is a smart idea. An NDA fulfills three main purposes: protecting the business, satisfying contractual requirements, and strategically gauging whether vendors are legitimate candidates.

Benefits of NDAs

NDAs protect your company by creating an obligation of confidentiality for all confidential information. Confidential information is generally the information that an organization would not want to be seen by its competitors or posted online. Not only does an NDA state that the recipient cannot share any confidential information, but it also ensures that the business can engage in legal recourse if a vendor does end up sharing that information.

As far as satisfying contractual agreements, many companies have existing confidential obligations to a third party. These existing obligations require the business to ensure that confidentiality is in place with any business partners or subcontractors with which it must share the third party’s confidentiality information for business purposes.

Sending out NDAs can also help an enterprise determine whether various vendors should be considered legitimate candidates.

For example, a vendor that readily signs an NDA shows that it is serious and truly interested in taking on the project. Meanwhile, a vendor that isn’t serious about the project or doesn’t value confidentiality may push back against signing an NDA. Plus, requiring a signed NDA upfront is wise because it ensures the company doesn’t continue into the negotiation process with a vendor before finding that it’s resistant to signing an NDA.

Another benefit of requiring signed NDAs before sending out RFPs is that they provide clarity between the organization and the vendors. They clearly specify which information is okay to share and which information is not, ensuring everyone is on the same page. In addition, NDAs prevent bid-rigging and collusion, which unfortunately take place frequently, especially in the case of particularly large contracts.

It’s highly recommended to have all vendors sign an NDA before sending them an RFP. There are some exceptions, such as when there is only a short lead time. In this case, an alternative is to include NDA language within the RFP. This language should state that the information contained in the RFP is confidential.

Types of NDAs

When deciding what type of NDA to send out, mutual NDAs are typically preferred over unilateral NDAs.

With a mutual NDA, both parties agree to protect the other’s confidential information. But with a unilateral NDA, the protection only goes one way.

The main reason that mutual NDAs are better to send to vendors is that they’re usually accepted more quickly by vendors’ legal teams. When sending out a unilateral NDA, there’s a higher probability of back and forth and redlining between the company’s legal team and the vendor’s legal team.

Obtaining Signatures

Rather than getting physical signatures, automating the NDA signing process using electronic signature tools like AdobeSign and DocuSign can speed up the process. This way, the internal team will have more time to focus on other parts of telecom procurement.

The Ideal Number of RFPs to Send Out

How many RFPs should a company send out? The ideal number depends on two main factors: the project’s size and complexity.

The size of the project refers to the anticipated dollar spend. As this amount increases, the number of RFP recipients can also go up. While small projects may only require two or three RFPs, larger projects may need as much as six or seven.

Meanwhile, the project’s complexity (along with the value of vendor innovation in offering a unique solution to a complex problem) is also directly related to the number of RFP recipients. The more complicated the project, the more RFPs should be sent out.

When a business is dealing with a complex telecom issue, more responses mean more innovative ideas to solve the problem. Plus, when more proposals come in, the business can better analyze the average pricing for these types of telecom services.

The prices and costs provided in proposals can also give a business a better idea of how well it has explained its requirements for the project.

For example, a wide spread between prices that doesn’t have a clear cluster or grouping can indicate that the vendors aren’t clear on the project’s scope. When the project’s scope isn’t easily understood by vendors, it can lead to delays and disputes later in negotiations.

Overall, a simple, low-budget project should only require two or three RFPs. A large, complex project may need as many as six to eight RFPs at the most.

Turn to TPG for Your Telecom Procurement Needs

Whether you’re having a hard time choosing potential vendors or need assistance strategizing your organization’s procurement process, Technology Procurement Group is here to help.

Not only do we offer telecom procurement strategy consulting and IT procurement services, but we also provide telecom and wireless expense management, RFP management, wireless expense reduction, and telecom contract negotiation.

For more information, call us at 1-888-449-1580, email us at info@TPG-llc.com, or complete the short form at the bottom of the page. We look forward to hearing from you!