As your procurement team begins to negotiate back and forth with vendors and work on a contract together, the following 41 negotiation strategies and tips will make your efforts as effective as possible while helping you to push back against vendor ploys. We’ll also outline six tactic killers that you’ll want to watch out for.

Be sure to work together to identify the specific tactics you plan to use with each of the final two vendors. Going in with a set plan that all team members are familiar with increases the effectiveness of your business’s negotiation strategies.

We’ll also discuss tactic killers, the things that will prevent your tactics from working as they should. Keep reading to expand your arsenal of negotiation tools and learn how to secure your company a high-quality telecom contract. Besides these negotiation tactics, there is also telecom contract midterm negotiations option.

If negotiation with telecom vendors is a struggle for your team, consider working with Technology Procurement Group. Our industry professionals are here to share their knowledge and expertise as they assist you throughout the procurement process. For more information, complete the form on our Contact Us page. You can also get in touch by calling at 1-888-449-1580 or emailing at info@TPG-llc.com.

Disclaimer: The information found in this article is provided for educational purposes only and should not be construed as legal advice.

Table of Contents

Negotiation Tactics: Are They Ethical?

Are the following tactics considered ethical? Many of them are, without a doubt, but there are a few that your company’s procurement team may or may not feel comfortable using.

Here, it helps to consider the concept of puffery, which is advertising that promotes products and services with information that’s not based on specific facts. It’s entirely legal to advertise items using superlatives and subjective opinions, even without evidence to back them up.

Similarly, consider that vendors have a legal right to essentially tell “little white lies.” With these scenarios in mind, it’s easier to understand why procurement teams or buyers can therefore use bluffing or employ pretense to imply that their position is stronger than it is. Not only is bluffing considered fair to use in poker, but it’s also a generally accepted business practice that makes the following tactics totally fine to employ during the procurement process. Of course, if any tactics make your team uncomfortable, they can always be adjusted or avoided entirely.

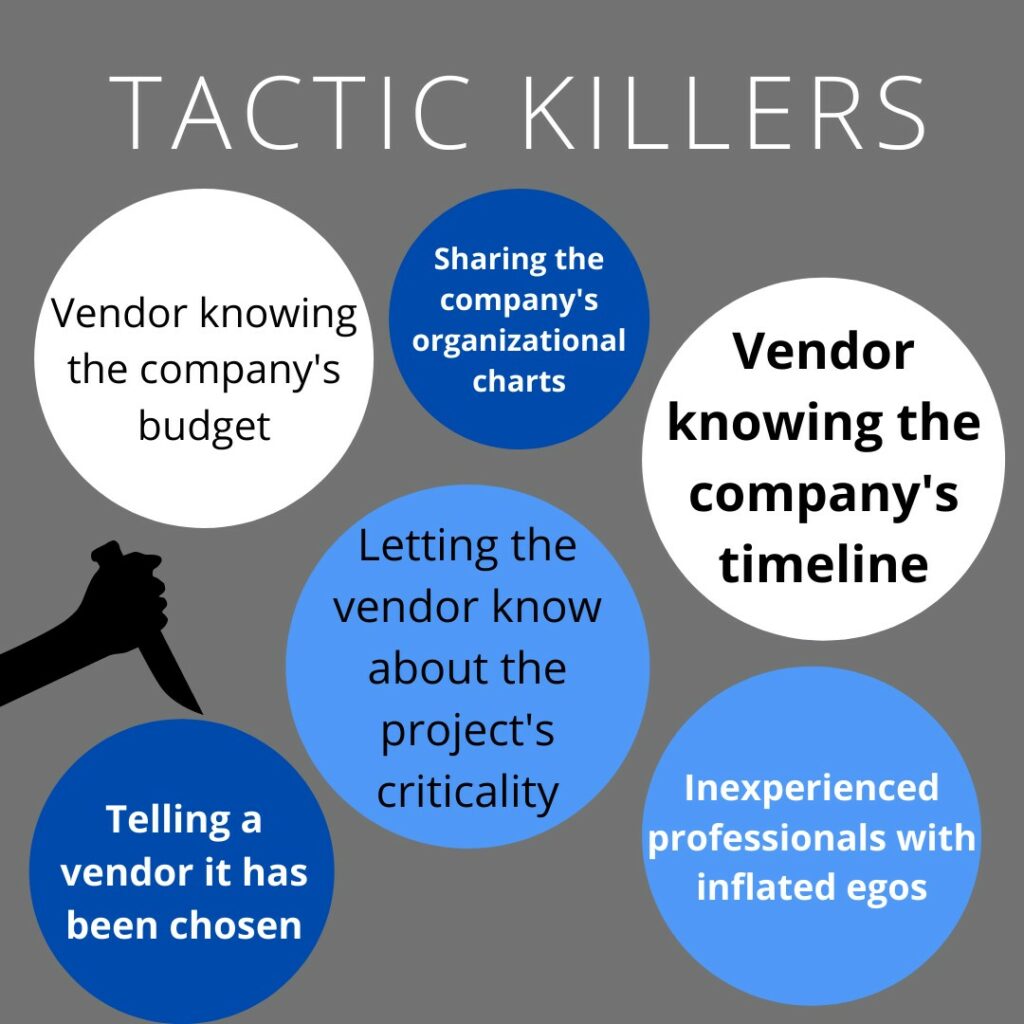

What Makes Tactics Go Wrong

Before going over numerous strategies that you can employ during negotiations, it’s important to know what can make tactics go wrong or not work in the way they’re intended.

1. Budget

The first tactic killer has to do with your company’s budget–and, more specifically, the vendor knowing your company’s budget. If the vendor has this information, its bid will unsurprisingly be almost precisely the budgeted amount, which means that your company will likely pay much more than it has to.

If a vendor asks directly about the budget for the project, there are several things that you can say in response. You can respond that you prefer not to reveal your budget, or that it’s none of the vendor’s business.

But an even better answer, which your procurement team can employ if they have a good idea of what the vendor’s price is, is to provide disinformation. Your team can say that your company’s budget is about 30% to 50% lower than it is in actuality. This forces the vendor to get creative with its pricing and drop the price much lower than it had intended.

Another option is to tell the vendor that there is no budget for the project–but if the vendor offers you a great price, you’ll find the necessary funds.

2. Timeline

The vendor knowing your company’s timeline is another tactic killer. Vendor sales reps will often ask questions to figure out the timeline and the start date in particular. Knowing this information makes it much easier to use time pressure and delay tactics against your procurement team, resulting in the vendor getting a better deal and your company ending up with a contract that isn’t as desirable as it had initially hoped.

When vendors ask about timelines, deadlines, and start dates, the best response is to say that it’s none of their business and that you know why they’re asking. Giving the idea that your team isn’t sure about the timeline or start date is also an option. You could even say something along the lines of, “The project will start the day after you offer us a great deal,” which doesn’t give away important information but motivates the vendor to structure its deal accordingly.

3. Importance of the Project

Informing the vendor of the criticality of the project at hand is another way to stop tactics from working before even getting the chance to use them. When a vendor knows that its products and services are vital to your company, it will become very inflexible regarding pricing, contract terms, and concessions. In short, if the vendor is aware that your company needs it or is relying on it, it’ll take advantage of that and get as much money and benefit from the deal as possible.

If a vendor asks about the project’s importance or criticality to your company, a simple response like, “We’ve gotten by this long without you; I’m sure we’ll continue to be just fine if the deal doesn’t work out,” shows the vendor that your company isn’t too concerned about losing it. This pushes the vendor to make its bid more attractive so that you’ll want to work with it and won’t want to lose out on the opportunity.

4. Organizational Charts

While it’s not too often that a vendor will directly ask you for your company’s organizational charts, it does happen sometimes. More frequently, though, the vendor will ask dozens of pointed questions to obtain the necessary information and put the chart together for itself.

The goal here is for the vendor to determine who your company’s decision-makers are and which executives it should build a relationship with. If it can directly influence company higher-ups and decision-makers, its chances of winning a beneficial deal (that isn’t nearly as beneficial for your company) go up substantially.

When your procurement team recognizes that the vendor is attempting to gain information on the company’s organizational chart, a response that turns things around on the vendor should be sufficient. Something like, “Sure, I’ll give you our organizational chart–but I’ll need to get yours as well, and I’d also like you to introduce me to the VP of Sales,” should stop the vendor from continuing its line of questioning.

5. Inexperienced Professionals with Inflated Egos

Unfortunately, procurement professionals who can’t keep quiet and believe they’re the best at negotiations tend to sink deals and kill tactics the fastest. The worst part of this is that the vendor will lead the professional to believe that they got an excellent deal, which only reinforces the belief that they’re excellent at what they’re doing.

Thus the pattern repeats itself, and your company is exposed to high risk and loss of money, especially as time goes on. It’s essential for all members of your team to be educated and aware of vendor ploys and negotiation tactics so that this situation doesn’t occur. Your procurement team must know the path to walk you to more profitable contracts by offsetting telecom vendor advantages.

6. Letting a Vendor Know It Has Been Chosen

When a procurement team pre-negotiates with multiple vendors during the competitive bidding process, many of the vendor ploys and negotiation tactics are unnecessary and won’t even be used.

But it will become impossible to negotiate when a vendor knows that it has been chosen and that it’s no longer in competition with others. Instead, your company will essentially beg the vendor to make concessions, and the vendor will be able to refuse because it knows it already has the deal in the bag.

Rather than letting the chosen vendor know that it has won, it’s better to create a shortlist of potential vendors and pre-negotiate with at least two of them before awarding the contract. Vendors must know that your company is still considering multiple options; this is what will motivate them to offer up more competitive bids and BAFOs. Only after the deal is agreed upon and the contract is signed should it be announced who the winning vendor is.

Negotiation Tactics for Your Procurement Team

Now that we’ve covered tactic killers, let’s get into the tactics themselves.

1. Focus on the Short-Term

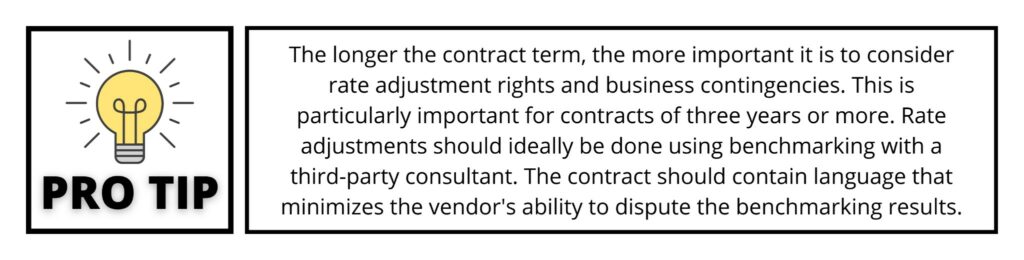

Aiming for the short-term is a valuable strategy to keep in mind during telecommunications procurement.

Technology advances extremely quickly, and so can businesses. When negotiating with telecom vendors, it’s best to secure contracts of no longer than three years.

2. Always Keep the Organization’s Objectives Top of Mind

Telecom contract negotiations are often long and complex, but it’s essential to keep your company’s main objectives in mind at all times.

In most cases, these objectives have to do with gaining better pricing, new services, sufficient provider capacity, timely provisioning, well-constructed Service Level Agreements (SLAs), and high-quality customer support.

3. Insist on Names and Numbers

With delay tactics, reneging, and so many other strategies at the vendor’s disposal, one way to maintain some power and leverage is to get contact information for specific sales reps and other professionals who work for the vendor. This way, if issues crop up during negotiation, your procurement team will have a list of people with whom it can contact and communicate directly.

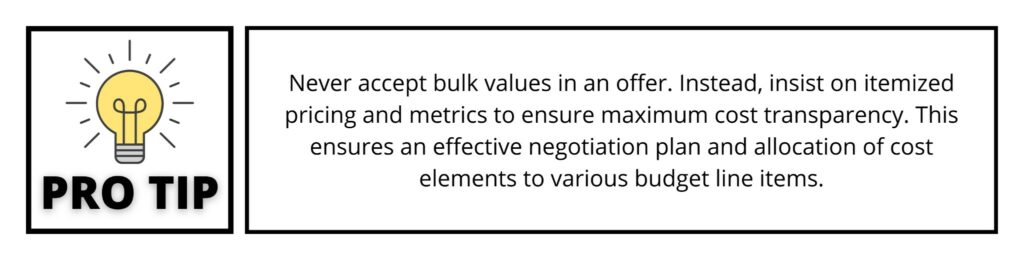

4. Research and Ask About Rate Variances

Your team may encounter rate variances between bids that require further research. Frequently, one vendor will have a much higher or much lower rate than others for a particular component or service.

This difference can be used as leverage in order to push higher-priced vendors lower. Saying something like, “Your pricing is 12% higher than other offers for this service,” encourages a vendor to either match or bring its pricing below that of its competitors.

5. Get Familiar with Fees and Promotions

It’s typical for telecom contracts to be riddled with various fees: usage fees, overage fees, and so many others. Be sure to read through all of the fine print within the proposed telecom contract and negotiate to eliminate any fees that aren’t fair to your organization or that will inevitably cost your business a lot of money.

While it’s smart for your procurement team to familiarize itself with fees, it’s just as beneficial to do plenty of research into the promotions run by the telecom provider.

This enables your organization to benefit from additional savings and deals that the provider may not mention upfront. Look into promotions currently run by the vendor as well as those it ran in the past.

It can also be advantageous to research promotions run by the telecom provider’s competition, as this can provide your company with leverage. Mentioning these promotions during negotiations can enable your business to obtain a more individualized contract that implements competitive promotional pricing.

Remember, in general, the more knowledge your company’s procurement team has, the more power it has and the better it can negotiate.

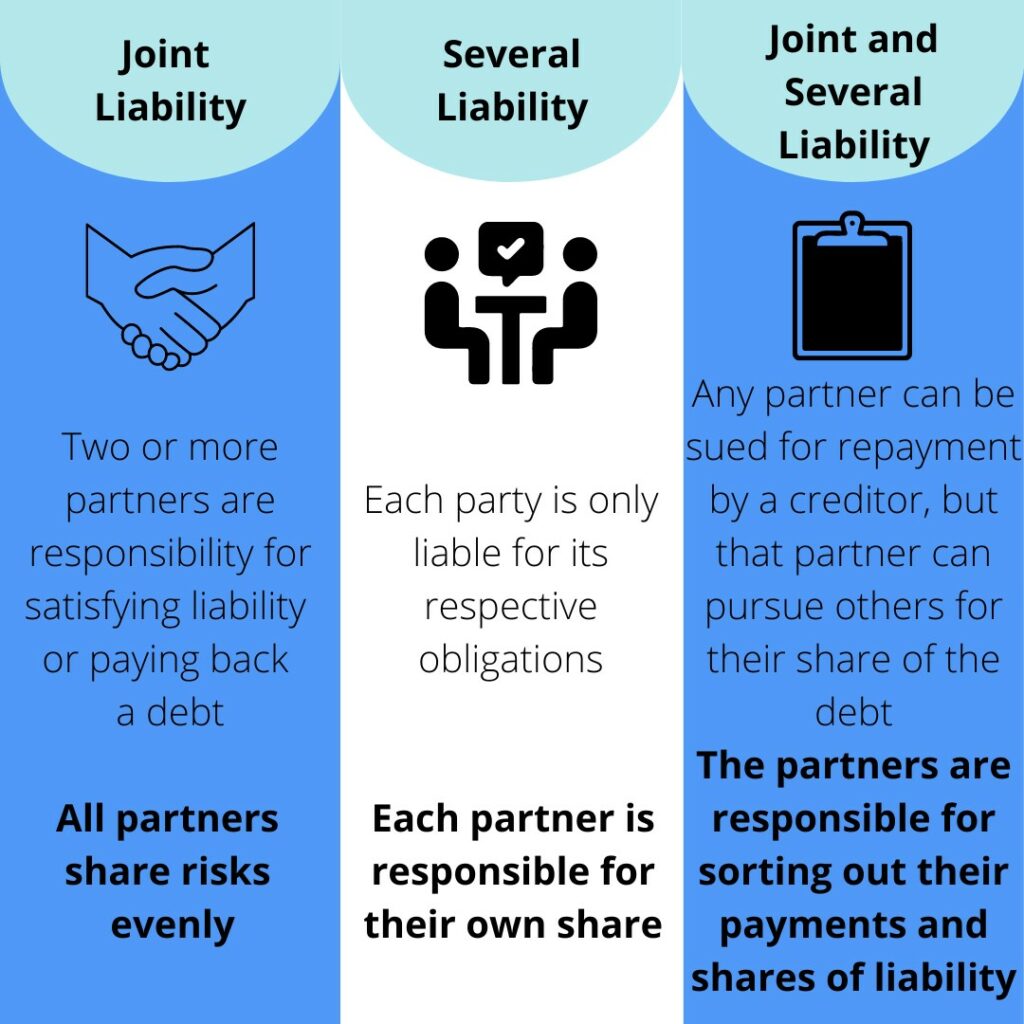

6. Understand Joint Vs. Several Liability

Your procurement team will want to be sure that the telecom contract is clear regarding all business affiliates, subsidiaries, franchisees, dealers, associates, and other users’ ability to get rates that have been negotiated in the agreement. It’s essential to understand the issue of joint vs. several liability for affiliates. Here’s a quick rundown.

Joint Liability

Joint liability is when two or more partners are responsible for paying back a debt or satisfying a liability. It allows all partners to share risks evenly and helps them protect themselves if they’re sued. Generally, this type of liability happens when two or more parties apply for credit together. Then, if any of the parties in the partnership enter into a contract, all of them are responsible.

Another part of joint liability is that a creditor can sue any of the partners that make up the partnership. In most cases, the creditor will sue the partner it views as the most financially solvent.

Joint liability is basically the opposite of several liability, which is explained below.

Several Liability

Also called proportionate liability, several liability refers to all parties being liable for only their respective obligations. An example of several liability is when multiple business partners take out a loan for their business, stating that each partner is only responsible for their own share. This is referred to as being “severally liable.”

When partners are severally liable and one partner doesn’t meet their obligations, the lender can only sue that particular partner.

Joint and Several Liability

Aside from joint liability and several liability, there’s also joint and several liability. Joint and several liability is a variation of joint liability in which a creditor can sue any partner for repayment. However, that partner is permitted to pursue other partners in order to collect their share of the debt.

The major difference between joint liability and joint and several liability is that the partners are responsible for sorting out and reconciling their separate payments and shares of liability.

7. Ensure Your Company Can Change Services Without Penalty

Telecom contracts last for an average of 36 months, and during that time, technology can evolve quite a bit. This means that the products and services that currently suit your company may no longer be ideal later in the contract term.

In fact, they may be replaced by different ones as technology is upgraded. It’s wise to negotiate to include a clause stating that your organization will not be penalized for switching to other products and services.

8. Review All SLAs

Service level agreements (SLAs) are an essential part of every telecom contract. They define the level of service your company can expect from the vendor, specifying how service is measured. SLAs also detail any penalties or remedies that come into play if the specified service levels aren’t met.

If the SLAs are nowhere to be found, that is problematic, as there may be nothing in the contract that defines the level of service the vendor must provide. Businesses must advocate for themselves in this situation and require that the vendor write up SLAs.

When they are present, your team will need to take the time to review all of the SLAs. Sometimes, vendors slip unfavorable terms into Service Level Agreements, and this is something you must be on the lookout for.

Procurement professionals must also ensure that the service levels defined in the SLAs are reasonable and agreeable. Here are some of the specific parts of the Service Level Agreement that your procurement team must pay particular attention to.

Provisioning Intervals

Provisioning is a process in telecommunications that involves preparing and equipping a network so that it can provide services to users. The provisioning interval starts when the contract is signed and ends when the new telecom services are ready for activation. Provisioning intervals can vary depending on the systems and networks being installed and prepared, but often, they are between 14 and 30 days long.

Outage Resolution Intervals

Outage resolution intervals refer to the amount of time a vendor is permitted to take to resolve an outage before having to give service credits. This interval is typically defined as an hour or less, but can vary. It’s best to negotiate so that the outage resolution interval is as short as possible.

Escalation Procedures

When your company has a complaint, concern, or other challenges regarding its telecom services, the escalation process is used to either move the complaint to a more senior vendor representative or to one capable of initiating a related process.

Escalation procedures are established within SLAs so that companies can notify upper management of problems with service or operational systems. Often, SLAs will define various classification criteria so that issues can be organized by levels of severity. Depending on the level of the complaint, your company may have different contacts to reach out to or a different procedure to follow in order to address the problem at hand.

Remedies

Not only do Service Level Agreements define the level of service your organization can expect from its telecom provider, but they also lay out remedies that will be provided to your organization in the event that the provider doesn’t meet the agreed-upon service levels.

Many service providers have SLA “objectives,” rather than specific measures, that generate credits when they are missed. Although it can be difficult to convince a telecom provider to change these objectives into clear measurements, it’s absolutely worth discussing and negotiating.

Generally, when a telecom provider misses its minimum performance standards, your organization receives service credits. The provider and your company come to an agreement regarding a certain percentage of monthly fees that will be considered “at risk.” The service credits come from this percentage of monthly fees when service levels aren’t met.

In most cases, the percentage is equal to the vendor’s profit margin. This method incentivizes telecom providers to maintain high performance without being too punitive.

Rather than using SLA provisions as punishments, metrics should ideally be utilized as an opportunity to have productive conversations regarding priorities, performance, and the future direction of the relationship between the provider and yourself as the customer.

The following are questions that must be answered clearly within the SLAs:

- What credits are to be given when service levels aren’t met?

- Will increased credits be given in the case of an extended period of incidence of failure?

- Are credits based on a fixed dollar value or a percentage of recurring monthly charges? If they are based on charges, does this refer to charges paid or due? Are the charges based on all leased capacity, or only the portion impacted by the failure?

- If there are multiple simultaneous service level failures resulting from the same cause, is your organization entitled to credits for both failures? Or is it only entitled to credits for the failure with the highest credit amount?

- What is the process for your enterprise to get the credits? Is it automatic, or is notice required?

- Are there any limitations on service credits, such as a cap on the total amount of credits that the provider will pay within a specified time frame?

- Are there any exceptions to the provider’s obligation to pay credits for failures (typically force majeure events and failures caused by the customer)? Are these types of events clearly defined?

- Can your company cancel the contract after a certain number of adverse service level issues?

As service credits and termination rights are typically the customer’s only remedy for service level failures, it’s vital to ensure that there are practical and enforceable processes set up within the SLAs. In most cases, you can’t pursue separate claims against the telecom provider for damages resulting from service level failures or even breach of contract; this is why paying attention to language around service credits and termination rights is so crucial.

Earn-Back Provisions

Some vendors may include a clause discussing the right to earn back paid service credits. This essentially allows the vendor to earn back the service credits they’ve given up if they meet the agreed-upon standard service level for a certain period of time.

Many vendors argue that an earn-back provision is fair, but in reality, it undermines the service credit approach as a whole. If there is an earn-back provision within the SLAs, it’s in your business’s best interest to attempt to remove it.

9. Know About the Telecommunications Service Priority Program

The Telecommunications Service Priority, or TSP, is a program run by the Federal Communications Commission (FCC) and managed by the United States Department of Homeland Security.

The purpose of TSP is to require telecom service providers to give preferential treatment to those enrolled in the program anytime they need to add new lines or have lines restored after a service disruption. The TSP program is always in effect, and to enroll in it, organizations must have federal sponsorship.

Organizations that should enroll in this program include police and fire departments at the tribal, local, state, and federal levels, as well as 911 call centers and public safety answering points. Other qualifying organizations are EMS entities, essential healthcare providers, and other organizations that use telecom services to maintain law and order or public health and safety.

Any organization that relies on telecom services daily to perform critical emergency preparedness and national security functions needs TSP. It functions as a type of insurance policy, because by enrolling the organization’s critical communication lines in the program, the law requires the organization’s telecom provider to prioritize the restoration of its lines or the addition of new ones before it services any non-TSP enrolled customers.

During major disasters or attacks when telecom infrastructure is damaged, the TSP program is especially beneficial. It ensures that organizations enrolled in the program have their communications services restored in a timely manner.

Pricing as far as enrollment and monthly fees for the TSP program is set at the state level by public service commissions or public utility services. One-time enrollment fees (paid per line) are usually $100, with monthly fees per line averaging three dollars.

10. Ensure Reasonable Contract Ramp Periods

In the telecommunications industry, the term “contract ramp period” has a few different definitions:

- The period starting after the contract is signed, encompassing the installation of necessary technologies and providing a time frame to reach the agreed-upon minimum commitment level

- The period between signing the contract and all technologies being installed and ready for use

- The period in which a company consolidates multiple carriers to a single carrier

- The period in which a company ramps up its commitments

Because this term’s meaning can vary, it’s important for your team to read your telecom contract closely to ensure you understand what the contract ramp period refers to.

The first definition listed above is the one that applies most frequently (the period starting after the contract is signed, encompassing the installation of necessary technologies and providing a time frame to reach the agreed-upon minimum commitment level). Here’s an example of how that type of ramp period would work:

The contract is signed, and your organization is given a time frame (for example, six months) to have all new services installed and billed at the agreed-upon minimum commitment level.

It may take 90 days to install the MPLS (Multiprotocol Label Switching) circuits and another 30 days to activate the SIP (Session Initiation Protocol) voice service. The next 30 days may be spent porting your organization’s phone numbers from the old service provider to the new carrier’s SIP service. Also within this time, your organization may need to RespOrg, or transfer, its toll-free numbers from the old carrier to the new one.

Another part of the activation process is testing everything out before initiating a change to your company’s internal call routing.

This enables all outbound local and long-distance calls to traverse the new network. This six-month ramp period (although the timeline may vary) gives your business time to reach its commitments. This especially refers to organizations working with carriers requiring sub-commitments on toll-free and outbound long-distance usage.

Often, the customer must spend a certain amount or write the carrier a check covering the difference between the actual usage and the minimum spend commitment. In agreements like this, it’s especially important to have a ramp-up period that allows your company plenty of time to have everything installed and working properly so that it can meet its commitments.

The second ramp period definition (the period between signing the contract and all technologies being installed and ready for use) focuses mainly on the vendor’s responsibility to get all services ready in a timely manner.

Depending on your organization’s telecom needs, the length of this type of ramp period can vary quite a bit. Your procurement team should ensure the stated ramp period is sufficient and reasonable regarding everything that needs to be installed, but also timely; you don’t want to be waiting to use your new telecom services for months on end.

The third definition (the period in which a company consolidates multiple carriers to a single carrier) is more focused on your company’s responsibilities. The stated time period should, again, be reasonable considering the amount of work that has to be done to complete consolidation.

Regarding the fourth definition listed (the period in which a company ramps up its commitments), the schedule for the ramp-up is set up on commitment, which can be based on usage, invoiced amounts, or product volumes.

One example is a minimum commitment of $10,000 per month for the first four months of the contract term, followed by a ramp-up to $20,000 per month for the following four months, and $30,000 per month for the rest of the contract term.

Another example employing a usage-based schedule might look like one TB (terabit) monthly for the first three months, two TB for the next three months, and three TB per month for the rest of the contract term.

Regardless of the type of ramp period, your procurement team should ensure that it is sufficient, reasonable, and timely considering the work that must be completed during that period.

11. Check for MARCs (MVCs)

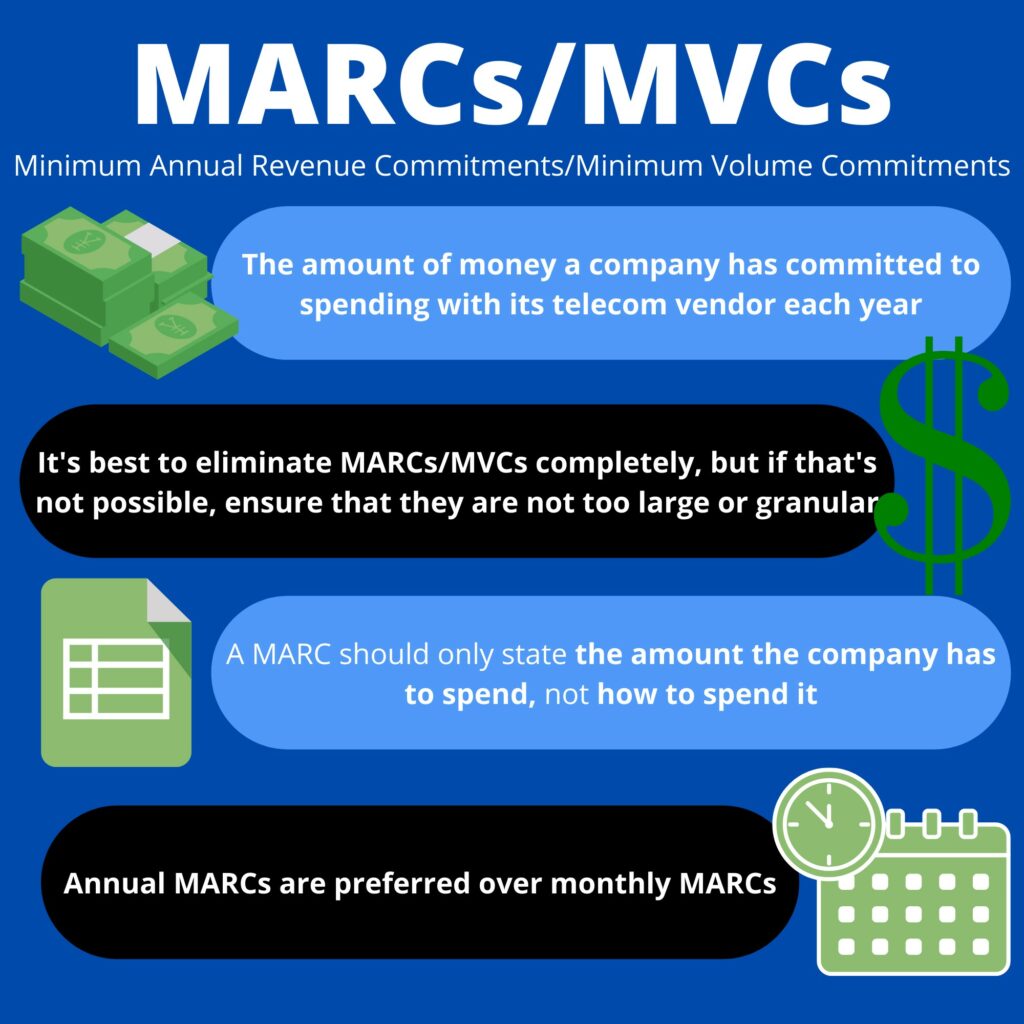

A MARC, or Minimum Annual Revenue Commitment (also known as MVC, or Minimum Volume Commitment), is the amount of money a company has committed to spending with its telecom vendor each year.

Although MARCs were once required, many vendors are now willing to forgo them completely. The best move is for your procurement team to negotiate to eliminate the MARC entirely, if possible. If a MARC is present in the contract, ensure that it’s not too large or granular. A MARC should only state the amount of money your company has to spend, rather than how it has to spend it.

In lieu of a MARC, carriers often ask for monthly spend commitments that start over each month. If an enterprise has to decide between the two, an annual MARC is generally better since your company would be able to meet it more quickly and exit the agreement near the end of the term, as opposed to having to stay in a bad agreement through the final month.

Be sure that if rates are expected to decline over time due to the vendor offering attainment discounts, your company will still have plenty of padding to meet the monthly or annual MARC commitments to which it’s agreeing.

There are several questions to ask a vendor if the company agrees to a MARC.

- What are the consequences of failing to meet monthly or annual MARC commitments?

- Are the commitments considered “take-or-pay” (100% liability), or is there a shortfall charge based on a percentage of the amount missed? (For example, if the MARC is $1,000,000 and the actual spend is $900,000, is your business obligated to pay the full $100K difference, or just 40% of the balance of the agreement?)

- Some providers may attempt to reduce the discounts offered should your company miss its commitment. Is there an opportunity to “carry-forward” a missed commitment and make it up in future years?

- What happens if your organization exceeds its commitment? Will the additional spend be applied to future years?

- If your company has a monthly or annual spend commitment (MARC), do pre-discount amounts or post-discount spend amounts contribute?

- Are there any sub-commitments for the services? For example, is there a requirement to have a certain dollar amount of toll-free or long-distance usage to get the offered pricing? Is your company required to maintain a certain quantity of circuits or a dollar amount for data connections? Is there a minimum quantity of VoIP or SIP sessions that must be maintained?

If your procurement team is feeling overwhelmed with the procurement process, consider working with the professionals at TPG. We’ll be happy to guide you and provide expert insight every step of the way. Complete the form at the bottom of the page for more information, or reach out by phone at 1-888-449-1580 or email at info@TPG-llc.com.

12. Look for Flexible Scalability in Terms and Conditions

Flexible scalability should always be a part of the terms and conditions of a telecom contract, but it may require some negotiation on your part to ensure that the vendor includes it. Flexibility and scalability are essential for a growing business to continue meeting the needs of its clientele and customers.

13. Discuss T&C Before POC

Before engaging in a proof of concept (POC), make sure to talk through all required contract terms and conditions. This way, should your company like the product or service after the POC, it ensures that there won’t be any “deal-breaker” terms and conditions that will hold up the contract.

14. Get It in Writing

If the vendor refuses your company’s terms and conditions request three times, then what it is currently offering may be its best and final offer. To confirm this, ask the vendor to put in writing that no other customer has been granted these contract terms. (The vendor likely won’t put it in writing, which will provide your company with more leverage.)

If this happens and your company believes the terms and conditions it’s requesting have been offered to other customers before, then it’s wise to get proof from a consultant and raise this issue with the vendor.

15. Negotiate for a Technology Change Clause

When a technology change clause is offered by a third party but not by the incumbent carrier, then there are a few things to ensure:

- Your company must have the right to request that the incumbent carrier also provide a technology change clause.

- The clause should allow your company to use a competitive provider, reducing its contract commitment if the incumbent carrier refuses a technology change or does not offer the new technology needed.

- Both parties need to understand what constitutes being “available in the marketplace” and how this right comes into play.

When the incumbent carrier offers this clause, your procurement team needs to negotiate its right to reduce your organization’s commitment to reflect new efficiencies with new technology.

Another essential part of the clause should guarantee that your company can purchase the latest technology at the lowest available price. In the case of upgrades, your company should be able to upgrade individual service components without incurring one-time or termination charges.

16. Watch for Growing Commitments

Beware of contract commitments that grow over time. The only exception to this is initial contract ramp periods. These should enable a reasonable migration time to turn up services and begin sending long-distance or toll-free usage to the new provider.

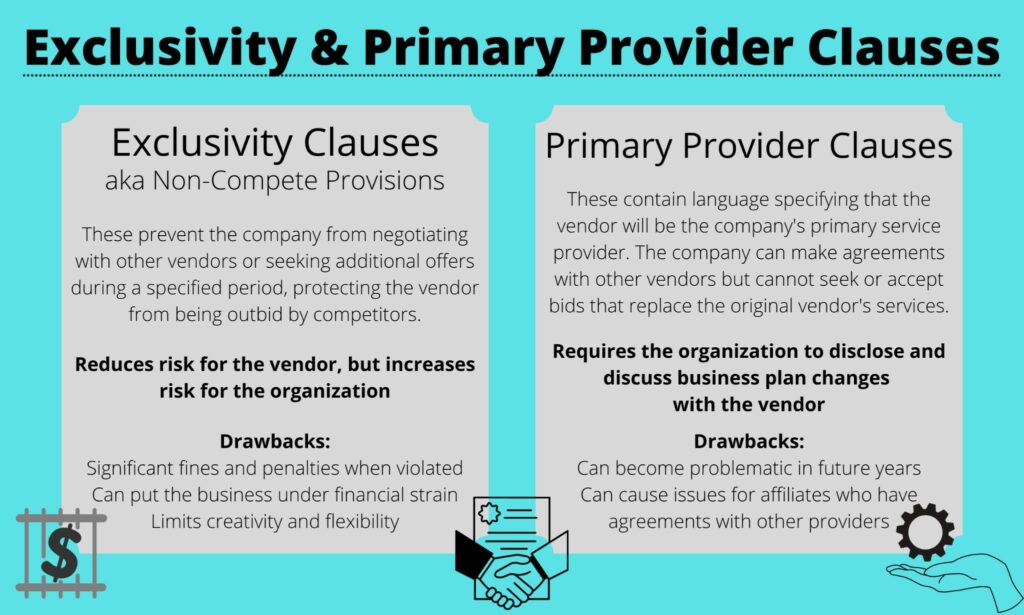

17. Avoid Exclusivity and Primary Provider Clauses

Exclusivity clauses are also commonly referred to as non-compete provisions. Their purpose is to prevent your company from seeking offers or negotiating with other vendors during a specified time period. This protects the vendor from being outbid by its competitors. For the vendor, having an exclusive relationship with a customer reduces risk.

Generally, exclusivity clauses restrict your business from buying, selling, and promoting goods and services from other vendors.

However, although exclusivity clauses decrease risk for vendors, they increase risk for customers. In the case that your company violates the exclusivity clause, there will likely be significant fines and other penalties, such as cancellation of the contract or more extreme legal action. There have even been cases in which exclusivity clause violators have been prevented from purchasing competitors’ products and services.

There are multiple other drawbacks of exclusivity clauses as well. For example, they can put your business under financial strain. Better opportunities may arise, and your organization won’t be able to accept them because that would violate the exclusivity clause. Exclusivity can also limit creativity and flexibility and result in a prolonged period during which your business cannot take other opportunities. Make sure that the important terms and clauses of telecom contracts are included in your contract.

Primary provider clauses are similar to exclusivity clauses, although they’re not exactly the same. Primary provider clauses typically have language that specifies the vendor will be your company’s primary service provider. Although your company is free to make agreements with other vendors, it doesn’t have the right to seek or accept bids that completely replace the original vendor’s services.

Furthermore, primary provider clauses usually require your company to disclose and discuss any business plan changes with the original vendor during the specified timeframe.

Both exclusivity clauses and primary provider clauses can become problematic in future years, and they can also cause issues for affiliates who have agreements with alternative providers.

18. Negotiate Regarding Mergers and Acquisitions

What happens if there is a merger or acquisition between your company and another company? It may be wise to add contract language stating that if and when that happens, the vendor will agree to consolidate the two deals into one while maintaining the more favorable pricing.

Similarly, what if the vendor merges or is acquired and your company has contracts with both the original vendor and the one with which it is merging or being acquired? The team should ask the vendor to consolidate the two contracts while giving your company the best pricing components from each agreement.

19. Use “Approval Delays” for Better Timing

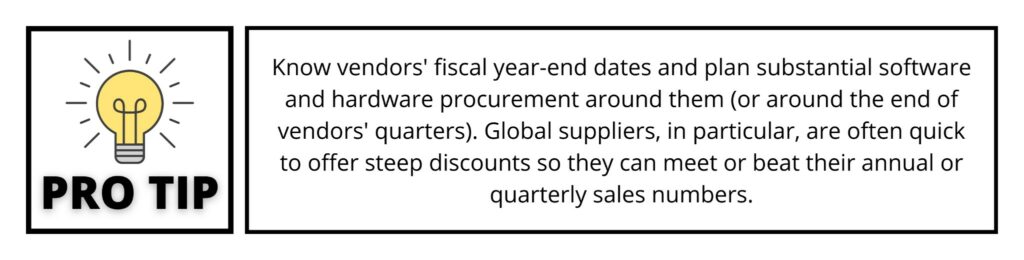

Timing the deal to close near the end of the month, quarter, or year helps your organization get a better deal. But when the timing isn’t lining up, one simple strategy is to engage C-level executives for “approval delays.” This allows the procurement team to blame the delay on the executives and their decision-making process, pushing the closing of the deal to the desired date.

20. Defer to Signature Authority

This tactic is especially rewarding because it only takes a few minutes and hardly ever fails. It’s similar to the previous tactic of utilizing approval delays and is another method of saving your company money. What you need to remember, though, is not to get too greedy when using it.

The basis of this strategy is to tell the vendor, “With this price point, I don’t have the level of signature authority to approve the deal. I’ll have to go to another level for approval. But if you can get your price down to (a certain amount), I won’t need to do that, and we should be able to finish up this deal before the end of the month.”

Mentioning the additional paperwork that will have to be done, plus the necessity of presenting everything to the steering committee and the fact that it will be difficult to get the deal approved at this higher level of signature authority, will really make this strategy hit home for the vendor.

The vast majority of the time, the vendor will respond to this statement from your team by revising its proposed pricing, often saving your company tens of thousands of dollars. This works best when the price is under $200,000 and can easily be quartered, since business expenditures often require signature level approvals that are broken down by quarters like $25,000 and $50,000.

Deferring to signature authority is highly effective because the vendor has limited visibility into your company’s business operations (so long as your procurement team has diligently prevented the vendor from learning more than it should).

The vendor believes the only thing keeping the deal from being wrapped up is someone’s signature. Because of this, it’s willing to essentially invest the difference between its original offered price and the signature level price. This way, the vendor can avoid the long wait time required for approval and, even more importantly, the risk that the deal may not get approved at all.

21. Use Deadlines to Your Company’s Benefit

If the vendor states that a particular deal only lasts until a specific date, then this aggression can be used against it to get your company the terms and conditions it desires. These concessions balance out the vendor’s aggressive deadline.

Rather than getting upset, it’s imperative that your procurement team remains calm and is prepared to walk away from the vendor if necessary. In many cases, the deal will be offered again, even after the stated date has passed (although there are no guarantees).

22. Don’t Settle for the First Price

The first price a vendor gives during negotiations is never its best offer. You should never agree to the first price given and should instead continue to negotiate until you receive a better deal.

23. Separate CapEx and OpEx

The vendor may attempt to bundle capital expenditures (major purchases intended to be used over the long term) and operating expenditures (day-to-day expenses that maintain business operations).

If this is the case, ask the vendor to separate them, reasoning that it’s necessary for Finance and CFO approval. Having the breakdown of CapEx and OpEx costs will improve your company’s leverage.

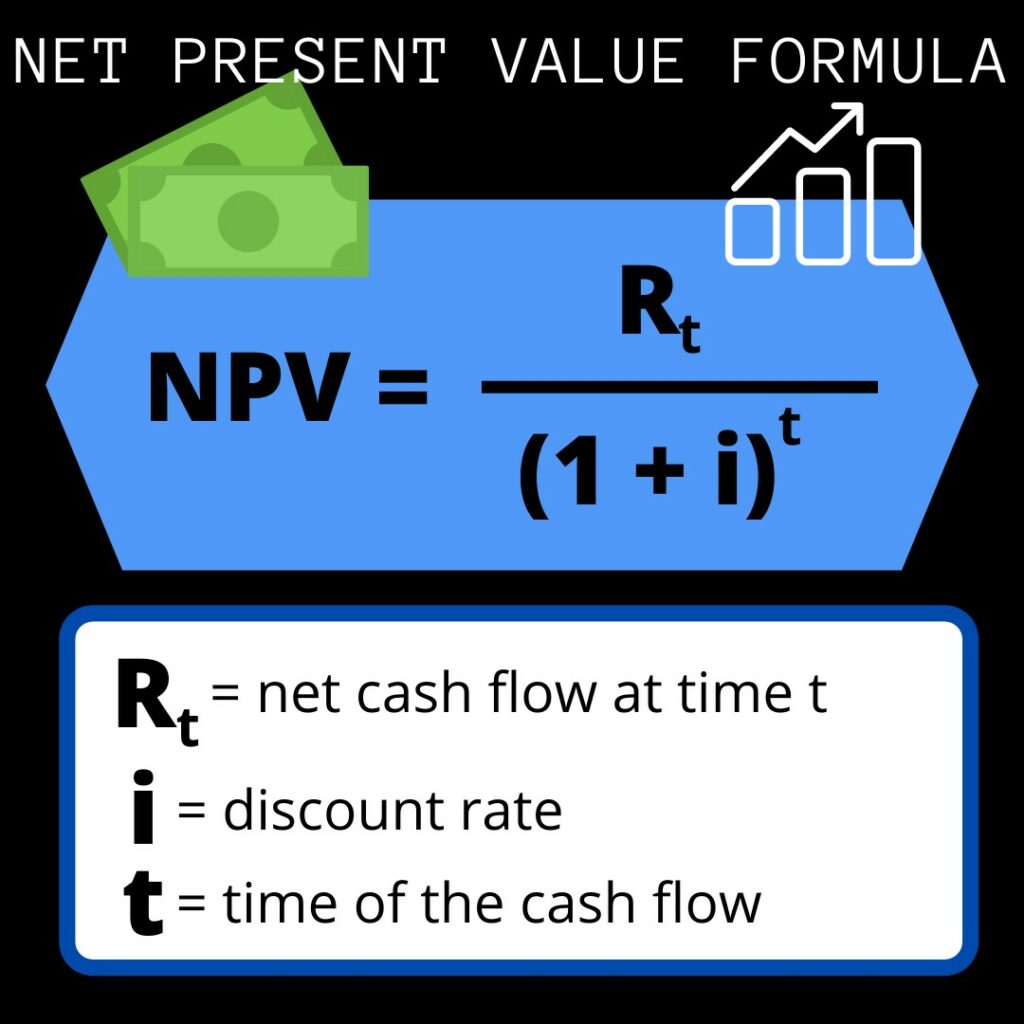

24. Calculate the Net Present Value (NPV)

If a vendor offers your company a multi-year prepayment option, it’s wise to calculate the Net Present Value of the deal.

NPV is a method of calculating your organization’s return on investment for a project. It consists of the current value of the cash flow at the required rate of return of the project in comparison to your company’s initial investment.

Compare the NPV to the pay-as-you-go option, and then calculate the actual discount. This enables your procurement team to push the vendor to further lower its rates in order to justify the prepayment option. Your team can ask for another best and final bid at this point.

25. Use Pricing Scenarios to Determine Vendor’s Cost Model

This tactic takes time and requires substantial effort and number-crunching on your part. Still, it’s worth it as it enables your team to figure out the vendor’s pricing model and use that information to its advantage.

The premise of this tactic is to ask the vendor about a variety of pricing scenarios. As a result, you’ll potentially gain enough data to reverse-engineer the vendor’s pricing.

Try to get information on at least three different pricing scenarios. Generally, it’s best to ask for pricing bundled, separately by line item, and by various durations (one-year versus three-year, for example).

In many cases, this will be enough to fill in the blanks and figure out how the vendor sets up its pricing model. More frequently than you’d expect, the vendor will mistakenly provide critical data to your procurement team. This often happens when spreadsheets are sent over, and the vendor forgets to delete a formula in a spreadsheet cell.

Once your procurement team has figured out the vendor’s pricing, it’s much easier to negotiate favorable pricing and terms for your company.

26. Consider The Good Cop/Bad Cop Strategy

Before employing this strategy, your procurement team needs to understand that it can backfire if overused. But employed correctly and sparingly, the good cop/bad cop tactic can help your company avoid saying “no” when it wants to, instead giving the team extra time to think. It can provide leverage and bargaining power as well.

The basic idea of the good cop/bad cop strategy is that negotiators who want to say “no” don’t simply say no. Instead, they blame the “no” on their “bad cop.” This method keeps negotiations positive and preserves the relationship between the negotiators and those they’re negotiating with (in this case, your procurement team and the vendor).

The key to the good cop/bad cop tactic during telecom negotiations is for the “good cop” to empathize with the vendor. Then, the “good cop” insists they need to consult a team member. This team member is unreasonable, constantly objects, or simply won’t agree.

Anytime negotiators on your procurement team want to say “no,” they blame it on their bad cop. This creates an opportunity for the good cop to defend the vendor later on and achieve a solution, causing the vendor to feel positively toward the good cop.

Alluding to the bad cop could sound like, “Our legal team would never go for this,” or “I don’t think I could ever get this approved by Finance.”

There are plenty of options available for the role of the bad cop. Advisors and experts like government regulators, auditors, and attorneys are one possibility. Bosses, owners, and the Board of Directors also work well as the bad cop. Even external pressures like the economy, media, consumers, or the market could play the role of the bad cop.

Another way to use the good cop/bad cop strategy is to have a procurement team member play the bad cop and a contract professional (if your team is working with one) play the good cop.

Your procurement team member takes on an uncompromising, adversarial style, while the contract professional has a more cooperative, softer tone.

Essentially, your team member plays hardball and allows the contract professional to work cooperatively with the vendor. The contract professional advises the vendor on how to appeal to your company’s procurement team and win the deal.

This good cop/bad cop variation tends to work quite well because it involves an unexpected role reversal. Typically, when companies’ procurement teams work with contract professionals, the end customer is the good cop, and the contract professional is the bad cop. This method flips the script on the vendor and can result in your company getting a better deal.

27. Have a Plan B

Always be ready with a “Plan B” that is clear and convincing. This way, your organization can walk away from the vendor should it refuse the requested pricing or key contract terms and conditions. (Always keeping two vendors in the running is vital to this strategy.)

Having a good story about your company’s Plan B will make the vendor sweat and get the deal done in your company’s favor.

28. Form an Effective Exit Strategy

When negotiating a telecom contract, it’s imperative to protect your company in every way possible. One method of doing so is to form an exit strategy that will come into play if your organization’s relationship with the telecom carrier takes a turn for the worse.

Consider what will happen if your company no longer wishes to do business with and remain contractually bound to the provider.

This is why it’s so important to include an exit strategy within the contract’s terms and conditions. This exit strategy should come in the form of a clause that allows your company to terminate the agreement for any reason without having to pay any early termination fees.

Of course, this is the best-case scenario; often, telecom providers will not agree to a termination clause that allows your company to end the contract for any reason without penalty. However, it’s still wise to negotiate as much as possible in order to put an exit strategy of some form into place.

29. Negotiate a Terminate-for-Cause Clause

A terminate-for-cause clause is extremely important and valuable for businesses. It gives them the power to break the contract without repercussions if the vendor underperforms or doesn’t deliver on what was agreed to in the contract. This means that your business won’t be stuck in a contract with a vendor that turned out not to be as beneficial as it initially presented itself to be.

30. Request Escalation

Be sure to ask for escalation of any requested pricing or terms and conditions that your business really desires. It doesn’t hurt to ask a higher level of management for these terms; this may be exactly what your company needs to do in order to get what it wants out of the telecom contract.

31. Ask for Vendors’ BAFOs

Asking vendors for their BAFOs can be advantageous because it gives the vendors a final opportunity to improve their bids. This could mean clarifying or modifying various details, making concessions, providing additional information, or reducing prices. Asking for vendors’ BAFOs is especially useful when:

- Previous bids have not fully addressed your company’s needs

- Bids aren’t clear and sufficient

- Bid costs are too high

Reasons to ask for a BAFO include:

- Increasing vendors’ understanding of your organization’s requirements

- Enhancing competition between vendors

- Encouraging innovative solutions

- Exposing potential risks

- Allowing vendors to adjust their bids for any new market conditions or advances in technology

It’s important to note that if vendors are satisfied with their original bids, they do not have to make changes to them.

32. Remain Silent

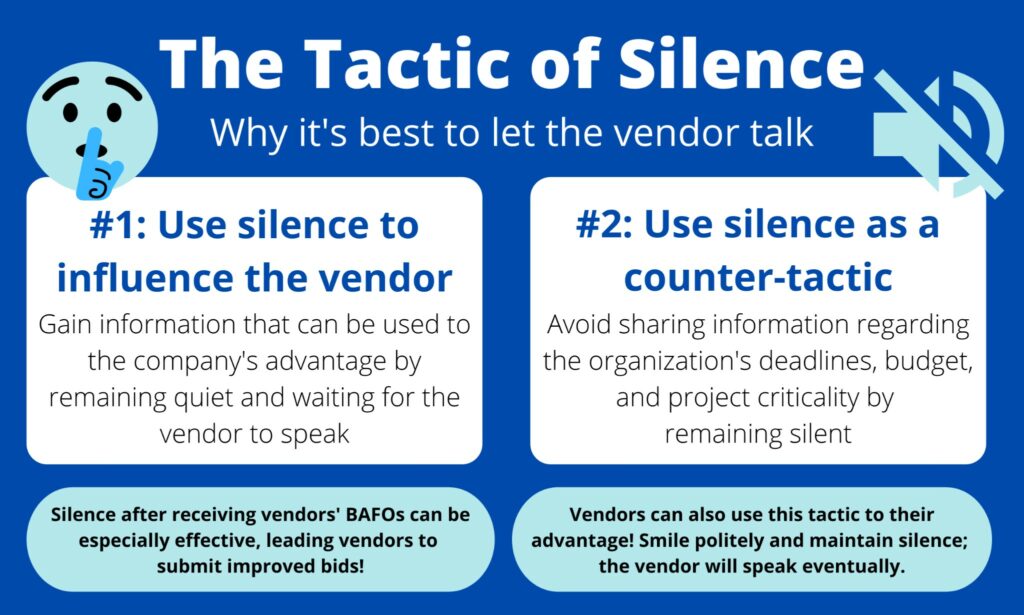

Many have heard the phrase, “The person who talks first loses,” in regards to negotiations. This adage isn’t always true, but what is true is that remaining silent is often advantageous. The key here is to let the vendor talk.

There are two aspects to this particular tactic. First, your procurement team can use silence to influence the vendor. Your team may want the vendor to either make a concession or provide information that can be used to your company’s advantage. The more your team knows, the more concessions it will be able to get.

Second, your company’s procurement team can use silence as a counter tactic to prevent the vendor from gaining the information it needs. If the vendor learns too much about your company’s deadlines, budget, and the criticality of the project, it gains leverage and power over the negotiations.

Using this tactic sounds exceedingly simple, but tends to be more challenging in practice. This is because, in the United States, there’s a culture-based pressure to avoid silence, which is precisely what procurement professionals are required to do in order to use this tactic successfully.

Staring at the vendor sales rep and staying quiet will feel quite awkward, but it’s necessary. The silence unsettles the sales rep and knocks their confidence, throwing them off track.

One point at which silence can significantly impact negotiations is directly after receiving vendors’ BAFOs (Best and Final Offers). When vendors don’t hear back from you after giving their best offer, they tend to panic and revise the proposal to be even better–offering lower pricing, additional concessions, free training, or a more lenient ramp period.

Throughout negotiations, when the vendor asks questions that your procurement team deems it prudent not to answer, it’s best to respond with a question or to rephrase what the vendor just said in the form of a question.

Turning the vendor’s questions around puts your procurement team in a position of power and moves the pressure onto the vendor. It also allows your team to respond to the vendor, rather than staying silent, but without giving up any information that the vendor can use to its benefit.

Something to note is that the vendor can also use silence as a strategy. When your team notices this taking place, the best thing to do is smile politely and maintain silence. Eventually, the vendor will speak.

Remaining silent is a form of protection for your company that doubles as a way to make the vendor potentially give up information. It’s straightforward yet powerful.

33. Slow Down

Similar to the Remain Silent tactic, Slow Down sounds easier than it is in practice. It’s pretty self-explanatory; the idea is just to slow down, rather than to speed through negotiations.

With the amount of time pressure that is often put on negotiations, this can be a true challenge. But rapidly moving through negotiations results in mistakes and overexposure of company information–and both of these lead to telecom deals that are less than desirable, with contracts that benefit the vendor.

Slowing down enables your company’s procurement team to ensure it’s on the right path with its responses to vendor ploys and its own employment of tactics and strategies.

Methods of slowing down include taking plenty of time to respond to vendor requests, avoiding conversations with the vendor about timeframes and deadlines, and not asking the vendor to get things done quickly.

This is highly effective because vendors are used to potential customers being in a huge hurry to get through negotiations. (And when the customer doesn’t seem to be in a hurry, it’s all too common for the vendor to manipulate them to feel they must move quickly.)

Vendors are aware that when a potential customer stops responding or slows down communications, there’s often something going on that isn’t beneficial to them. There could be a decrease in the project funding, or the customer could be considering making a deal with a different vendor.

Because of this line of thought, vendors will often respond to the silence and slowed communications by doing what they can to salvage the deal. They’ll be willing to make any necessary concessions as long as it means the agreement will start moving again and everything will get back on track.

34. Prepare Two Contracts

As far as redlining tactics for your procurement team to use are concerned, here is one that may or may not be considered ethical.

The first step is to prepare two versions of the contract. One of them should be structured precisely the way your company wants it, while the other should be agreeable to the vendor. Next, sign both contracts and fax only your company’s desired version to the vendor.

Reach out and let the vendor know that you’re only willing to go through with the desired version that you’ve just sent over. The vendor can either accept this version of the contract or reopen negotiations.

In most cases, the vendor will accept your company’s desired version of the contract rather than having to go through more grueling negotiations. However, if the vendor gets upset, your procurement team can send over the second version of the contract (the one the vendor is agreeable to).

35. Return to Ask One More Thing

Inspired by the TV show Columbo, this negotiation tactic only takes a few minutes. In the show, Lieutenant Columbo gives suspects a false sense of security by asking seemingly trivial questions throughout the conversation. Then, as he’s exiting the scene, he turns around to ask “just one more thing,” catching the suspect with their guard down and getting them to confess the information he needs.

Procurement teams can use a similar strategy to get a final concession from the vendor. The key is to wait until the vendor believes the deal is done before asking for one more thing. This “one more thing” needs to be a somewhat minor, very reasonable concession. It might be something like no-charge training, a future discount, or an additional product. Say something along the lines of, “If you can throw in just this one more thing, we have a done deal.”

The reason this works is that, since the vendor believes the deal is done and ready to go, it drops its guard. The vendor strongly desires to close the deal, be done with it, and reap the benefits. Therefore, as long as your procurement team asks for a reasonable concession, the vendor will likely agree to it.

36. Just Say No

For this strategy, when the vendor refuses to budge on pricing or contract terms, but your procurement team believes it can and should make concessions, your team tells the vendor that the deal is off.

Your team can use various reasons for calling off the deal; you can say the vendor’s price is too high, there isn’t enough money in the budget, the warranty isn’t good enough, or any other reason applicable to your company’s current situation.

Because of its finality, you should only use this negotiation tactic once, and only if the other tactics you’ve been using haven’t had the desired effect.

As a result, the vendor sales rep will often try to contact everyone they can from your company in an attempt to find someone they can exploit to put the deal back on the table. As long as everyone is on the same page and holds firm against the vendor, the vendor will typically decide to make some concessions rather than completely lose the deal.

For this tactic to work, it’s vital to be completely serious about calling the deal off, and it’s also critical that everyone at your company understands the strategy so that the vendor isn’t able to find anyone willing to give in.

In some cases, the vendor will not budge at all, and that’s one of the reasons why it’s essential to be working with at least two vendors until the deal is finally awarded and the contract signed. Much more frequently, though, the fear of completely losing a sale leads the vendor to suddenly become flexible regarding pricing and contract terms.

37. Ensure Vendor Commitment and Action Through Contract Language

Contracts must be as explicit as possible when stating your company’s performance expectations for the vendor. Using the right words and explaining various terms can be the difference between ensured vendor commitment and lack of obligation and follow-through.

Below, find a checklist that should help your procurement team effectively spell everything out for the vendor.

- Define all services and deliverables that the vendor is responsible for providing to your company.

- If there are any particular terms for the purposes of the contract or any attached exhibits, schedules, or addenda, include clear definitions of them.

- Define any out-of-scope areas of the contract. By doing so, the agreement implies that anything not defined as out-of-scope is in-scope.

- Define the scope of the vendor’s authority.

- Establish which party is responsible for project management tasks like scheduling and planning.

- Provide examples within the contract of what deliverables should look like.

- Define both service levels and remedies for the vendor.

- Provide the project schedule with milestones.

- Define any special requirements regarding testing or acceptance.

- Specify any vendor staffing requirements, including functional titles, skill sets, and quantity of resources required. (If the contract is results-based, which is recommended, this is not necessary.)

- Lay out any technical and functional specifications.

- List any resources that your company will provide to the vendor.

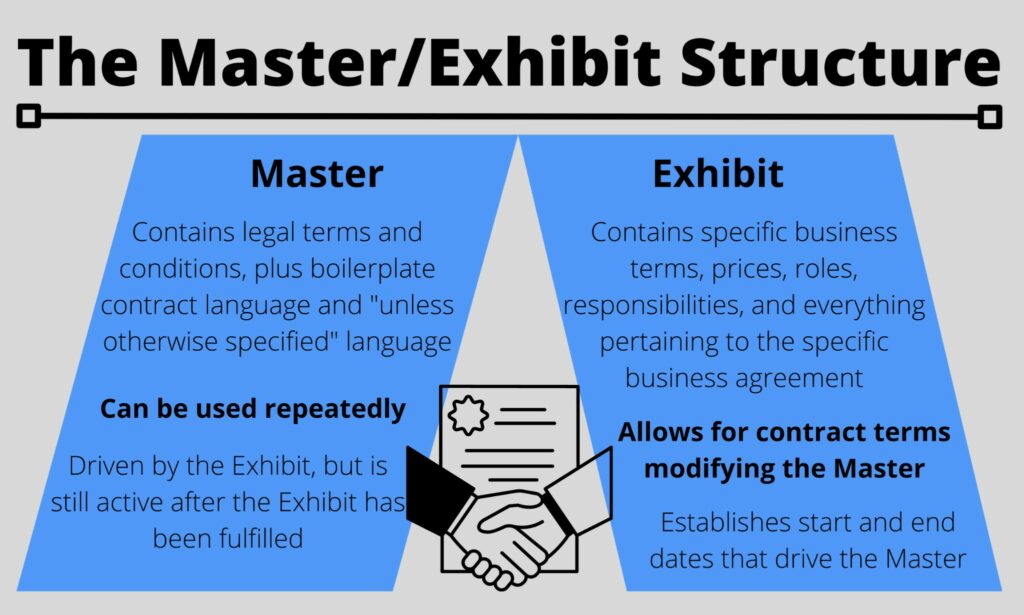

38. Use the Master/Exhibit Structure for the Contract Template

This structure is highly advantageous because of its versatility and efficiency. In short, the Master part of the contract template contains all of the legal terms and conditions, plus boilerplate contract language and “unless otherwise specified” language. This allows the company to use the Master repeatedly without having to make any adjustments.

The Exhibit, meanwhile, contains the specific business terms, prices, roles, responsibilities, and everything else pertaining to the business agreement between your company and the vendor. The special thing about the Exhibit is that it allows for contract terms that can modify the Master.

The key term to use within the Master is “Unless otherwise specified in the applicable Exhibit A…” This phrase allows for plenty of flexibility and prevents the need for amendments and addenda in the future.

It’s recommended that contract templates with the Master/Exhibit structure be perpetual, meaning that the contract only terminates if there’s a breach, another event of default, or one of the parties terminates it. This eliminates the need to keep track of the termination date or take care of renewing the contract.

However, the Exhibit is what drives the Master since it contains all the essential business terms as well as start and end dates. But even after the Exhibit has been fulfilled, the Master is still active. Some obligations, such as confidentiality, will remain in play.

39. Use Recitals in the Contract

There are two rules that essentially say that courts can’t look outside of a contract to determine its intent.

One is the Parol Evidence Rule, which states that oral evidence can’t be used to contradict written contract terms. In cases when all parties to a written contract have agreed to it as an integration, or a complete and final embodiment of the terms of the agreement, parol evidence can’t be used to change or add to those terms.

The other related rule is the Four Corners Rule, which says that courts cannot look outside the four corners of the contract to interpret its intent. These two rules mean that if something isn’t in the contract, it’s simply not in the contract. Still, there is a way to strategically evade these rules: recitals.

Recitals are a section of the contract that attempts to explain its story, especially to those who weren’t involved in drafting it. Recitals are hugely beneficial when contract disputes come up because they show the parties’ initial intent as the contract was drafted.

They tell how the contract came to be and how your company and the vendor decided to work together. It’s important to note that recitals do not have contractual force, but because they are a part of the contract, the court will see them (if a dispute makes its way to court).

It’s highly recommended to use extensive recitals in the contract to establish intent and clearly explain the contract to anyone who was not a part of the drafting process. The vendor may ask about the recitals, but it’s not often that it will want them removed.

40. Leave Out Two Words to Increase the Vendor’s Liability

This is an easy tactic to use when composing the contract template, and it dramatically increases the vendor’s liability.

Within the limitation of liability provision, the phrase “gross negligence and willful misconduct” is typically found. By simply saying “negligence and misconduct” instead, the vendor is subjected to much greater liability.

With the usual “gross negligence and willful misconduct,” the vendor would have to do something much more terrible to be held liable than it would if the words “gross” and “willful” were eliminated. Although this tactic doesn’t always work, it does at least half of the time and is absolutely worth attempting.

41. Ask for a Redline Comparison Document

If the vendor asks for last-minute changes to the agreement, request a redline comparison document to the original. This will prevent your organization from missing out on any “hidden” changes.

To improve your negotiating skills, you can also check top telecom and IT procurement tips that lead to success.

Take Your Negotiation Skills to the Next Level with Technology Procurement Group

If negotiations aren’t your forte and your contracts are suffering as a result, working with the Technology Procurement Group can change that. Our telecom industry professionals have the knowledge and expertise you need to optimize negotiations and secure contracts that help you reach your business objectives.

Not only do we offer telecom contract negotiation services and IT procurement services, but we also provide telecom and wireless expense management, telecom procurement strategy consulting, RFP management, and wireless expense reduction.

Getting in touch with TPG is easy. Call us at 1-888-449-1580, email us at info@TPG-llc.com, or fill out the simple form on our Contact Us page. We look forward to hearing from you!